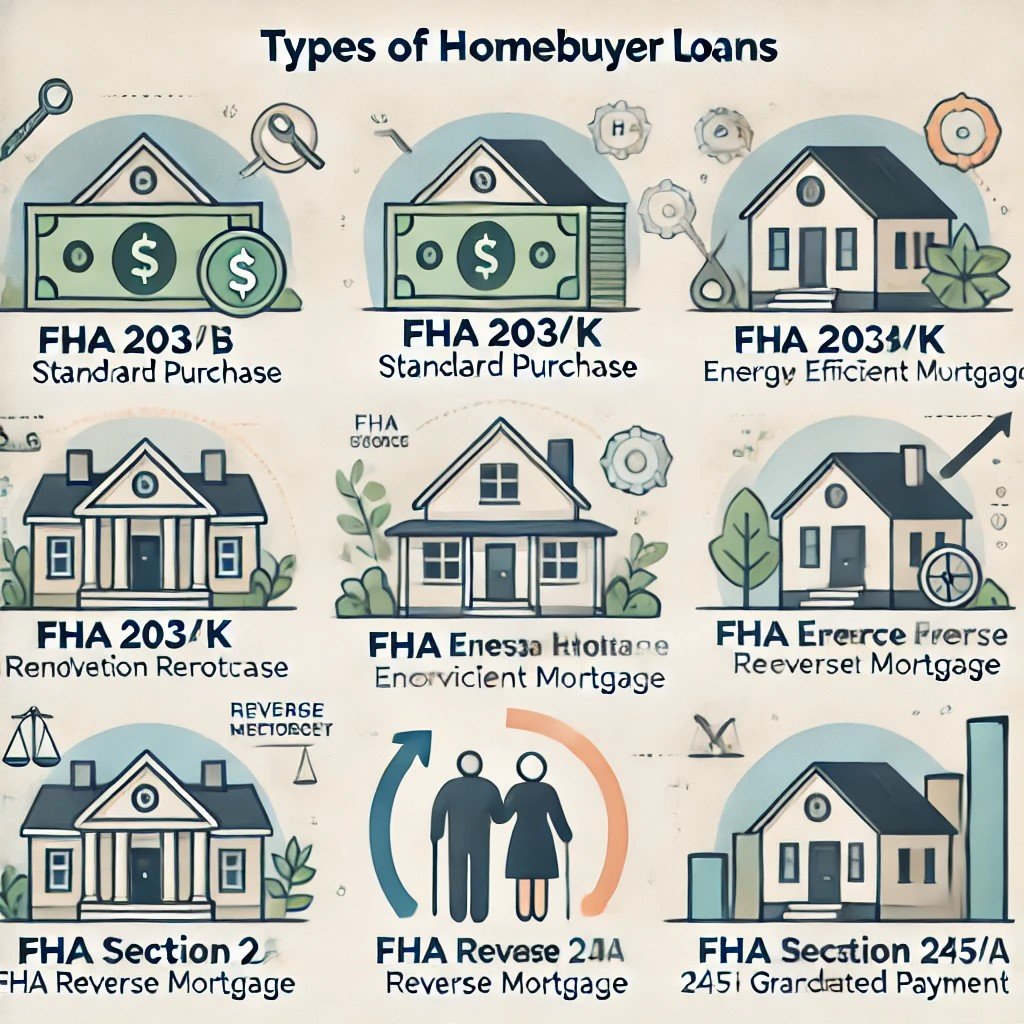

A Guide to FHA Loan Types: Finding the Right Fit for Your Dream Home

For many aspiring homeowners, the journey to purchasing a home can feel daunting, especially when navigating loan options. Among the choices, FHA loans are a popular, flexible option that has helped millions achieve homeownership. Backed by the Federal Housing Administration (FHA), these loans are known for their lower down payment requirements, flexible credit qualifications, and more accessible terms. But did you know that there are multiple types of FHA loans, each tailored to specific needs? Here’s a breakdown of the main types to help you decide which might be the best fit.

1. FHA 203(b) Loan – The Standard Home Purchase Loan

The FHA 203(b) is the most common type of FHA loan, often what people think of when they hear "FHA loan." It’s designed for individuals buying their primary residence and requires as little as 3.5% down payment.

Who It’s Best For: First-time homebuyers, individuals with moderate credit scores, and anyone looking for a simple home purchase loan with manageable upfront costs.

Benefits:

- Low down payment requirement (3.5% for credit scores of 580+)

- Lower credit score thresholds than conventional loans

2. FHA 203(k) Loan – The Renovation Loan

For homes needing repairs or renovations, the FHA 203(k) loan combines the purchase price and renovation costs into a single loan. This is an excellent option for people looking to buy a fixer-upper or remodel their existing home.

Who It’s Best For: Buyers purchasing a home that needs repairs, owners wishing to renovate, and buyers looking for a lower-cost property to customize.

Benefits:

- Covers a wide range of repairs and improvements

- Rolls renovation costs into the mortgage, avoiding multiple loans

- Standard 203(k) is for major renovations, while Limited 203(k) is for repairs up to $35,000

3. FHA Streamline Refinance – The Quick Refinance Option

Homeowners with an existing FHA loan may qualify for the FHA Streamline Refinance, designed to offer a quick and simple refinancing process. It can reduce the interest rate or change the loan’s term without requiring a full appraisal or extensive paperwork.

Who It’s Best For: Current FHA homeowners wanting to lower their monthly payments or shorten their loan term without going through a lengthy refinancing process.

Benefits:

- Limited paperwork and documentation needed

- Lower monthly payments or interest rates

- No home appraisal required in many cases

4. FHA Energy Efficient Mortgage (EEM) – The Eco-Friendly Loan

The FHA Energy Efficient Mortgage program is designed for buyers and homeowners who want to make energy-efficient improvements to their homes. With an EEM, buyers can roll energy efficiency upgrade costs into their mortgage, allowing them to save on utility bills over time.

Who It’s Best For: Environmentally conscious buyers, homeowners looking to make energy improvements, and anyone wanting to lower energy costs.

Benefits:

- Funds energy-saving upgrades, like solar panels or insulation

- Reduces monthly energy expenses

- Adds value to the home through efficiency improvements

5. FHA Reverse Mortgage (Home Equity Conversion Mortgage) – For Senior Homeowners

Available only to homeowners aged 62 and older, the FHA Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, allows seniors to tap into their home equity. Unlike a traditional loan, no monthly payments are required, and the loan is repaid when the homeowner moves out or passes away.

Who It’s Best For: Senior homeowners looking for financial flexibility or those wanting to supplement their retirement income.

Benefits:

- Provides tax-free cash flow from home equity

- No monthly mortgage payments are required

- Allows seniors to remain in their homes while accessing equity

6. FHA Section 245(a) Loan – The Graduated Payment Mortgage (GPM)

The FHA Section 245(a) loan, or Graduated Payment Mortgage, is a unique option that allows for lower initial payments that gradually increase over time. It’s ideal for buyers who expect their income to rise in the coming years.

Who It’s Best For: Young professionals or recent graduates who anticipate future income growth.

Benefits:

- Starts with lower monthly payments that increase gradually

- Helps buyers qualify with a lower initial income

- Allows for a more affordable entry into homeownership

How to Choose the Right FHA Loan for You

When selecting the right FHA loan, it’s essential to consider your long-term goals, budget, and the condition of the property. Here are a few quick questions to guide you:

- Do you need renovation funds? The FHA 203(k) could be ideal.

- Are you looking to refinance an existing FHA loan? The FHA Streamline Refinance might be the answer.

- Is energy efficiency a priority? An EEM could save you money and support your eco-friendly goals.

- Are you a senior seeking extra income? The HECM offers a reverse mortgage solution for those over 62.

Ultimately, FHA loans offer a variety of paths toward homeownership, making it easier for buyers from all backgrounds to purchase, improve, or refinance a home. Exploring these FHA options can help you make an informed decision that fits your financial goals and lifestyle.